“As a woman, always keep a man in the room.”

In Africa, having a husband earns you more respect. It doesn’t matter if it’s a bad marriage. It grants more street credibility and make people believe you’re own some form of stability.

Unfortunately, it’s the same in the global venture capital funding space.

In 2022, US women collectively raised $4.5B in VC funding.

This would have sounded really good, but it was a paltry 1.9% of the $238B raised for the entire year.

So who got the rest?

Teams with more men and at least, one woman founder.

When the team is mixed, VC funding raise jumps to 17.2%. According to Crunchbase, this trend has remained consistent for the last 10 years.

To commemorate International Women’s Day, I decided to extract data from Crunchbase to creat this Sankey chart for us to have something to let this sink in as we draw insights from the data.

So let’s get busy!

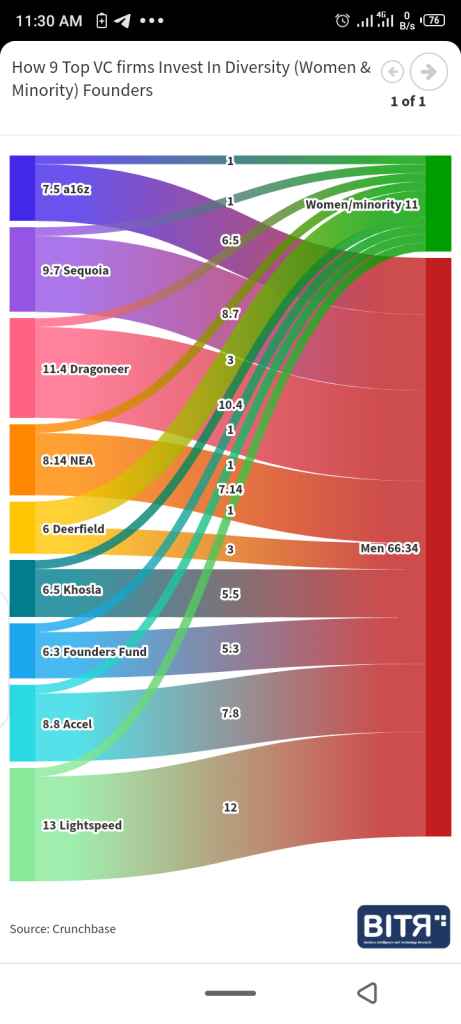

This is how 9 of the world’s largest VC firms invest in diversity (women and minority founders)

I looked at the data for the following companies; a16z, Sequoia, Dragoneer, New Enterprise Associates, Khosla Ventures, Founder’s Fund, Light Speed Ventures, and Accel

a16z: 1 diversity investment made for every 6.5 investments

Sequoia: 1 diversity investment made for every 8.7 investments

Dragoneer: 1 diversity investment made for every 10.35 investments

New Enterprise Associates: 1 diversity investment made for every 7 investments

Khosla Ventures: 1 diversity investment made for every 5.5 investments

Founders Fund: 1 diversity investment made for every 5.3 investments

Accel: 1 diversity investment made for every 12 investments

Light Speed Venture Partners: 1 diversity investment made for every 7.8 investments

💡 INSIGHTS

Funds earmarked for #diversity founders since the inception of these 9 VC firms;

💡 a16z: 15% since 2009

💡 Sequoia: 11% since 1972

💡 Dragoneer: 9.6% since 2012

💡 New Enterprise Associates: 14% since 1977

💡 Deerfield Management: 100% since 1994

💡 Khosla Ventures: 18% since 2004

💡 Founders Fund: 19% since 2005

💡 Light Speed Venture Partners: 18% since 2000

💡 Accel: 8.3% since 1983

💎 Deerfield Management is an outlier, investing in few later stage projects on an enormous scale with a lot of women on board at this stage.

💎 The largest VC funds earmark an average of 8 – 18% of funds to diversity since their inception.

💎 Peter Thiel’s Founders Fund has enabled more diversity funding at 19% followed by Khosla Ventures and Light Speed Ventures at 18% each since their 2000s founding. Leveraging the strength of diversity founders beyond foundational industry players like Sequoia and NEA.

Isn’t it alarming that in 2023, a woman needs to keep a man in the room to make the major cut of the funding chunk?

Happy International Women’s Day to all the #women #founders in the world and women VC introducing more diversity opportunities.