As one of the world’s most successful venture capital firms, hosting and having hosted some of the most successful unicorns and decacorns in its portfolio, a16z has harboured no fears in venturing into the rough waters of Web3 investing, AKA the Crypto/Blockchain market.

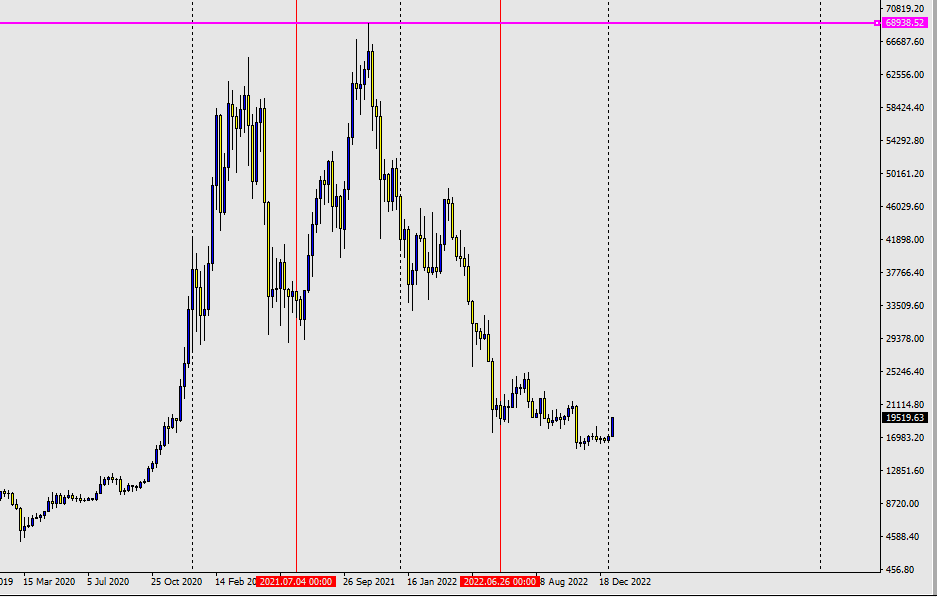

A16Z Crypto made strong showing through July 2021 to June 2022, investing across a diverse range of subsectors in the cryptoverse. Within this duration, Bitcoin, the major cryptocurrency, tanked heavily in June, made it’s all time high (ATH) above $68,000 in September and has stayed bearish as of this writing. As you may already know, the Bitcoin crash set off a domino effect across all altcoins and tokens bringing the entire market to the much talked about crypto winter.

A16Z Crypto is the Web3 fund of the global venture capital giant, Andreessen Horowitz (a16z). While Web3 has become an all encompassing word, habouring a long lineup of sectors, this fund is aimed at startups launching or that have launched their services or products on the blockchain. The blockchain being the underlying technology, or for simpler understanding, the manufacturing plant for cryptocurrencies. The fund is also focused on core crypto related projects such as exchanges.

A16z Crypto’s Investment Strategy

The fund is structured like a hedge fund and not a traditional VC fund, with a goal to hold crypto investments beyond the normal 10 year venture capital cycle, according to Yahoo Finance.

It shoots to maintain aggressive investing in both bull and bear markets, consolidating on its long term view of the market.

Also, it will look towards investing at all stages. Think: Preseed to late stage, and you will be on track.

A16Z Crypto Stats and Analytics

A16Z began investing in crypto in 2013 with a first investment in cryptocurrency exchange platform, Coinbase. A16Z has raised a total of $7.6 billion under its crypto fund, a16z Crypto from 2018 to 2022.

A16Z has invested in a total of 113 companies since inception, with 75 of these being crypto/blockchain startups according to data from blockdata. There has been 4 major fails off these investments including Diem, OpenBazaar, Basis and B17 Clout.

Investments from July 2021 to June 2022

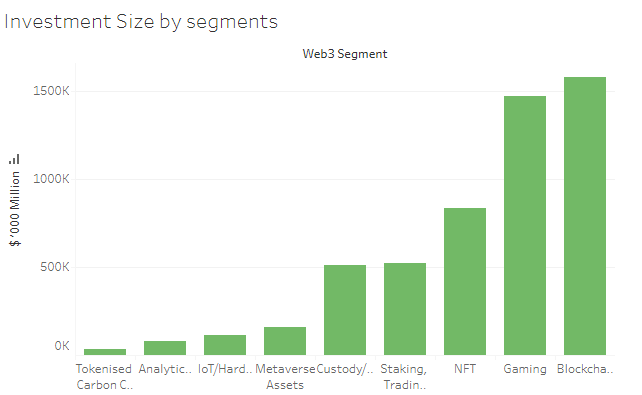

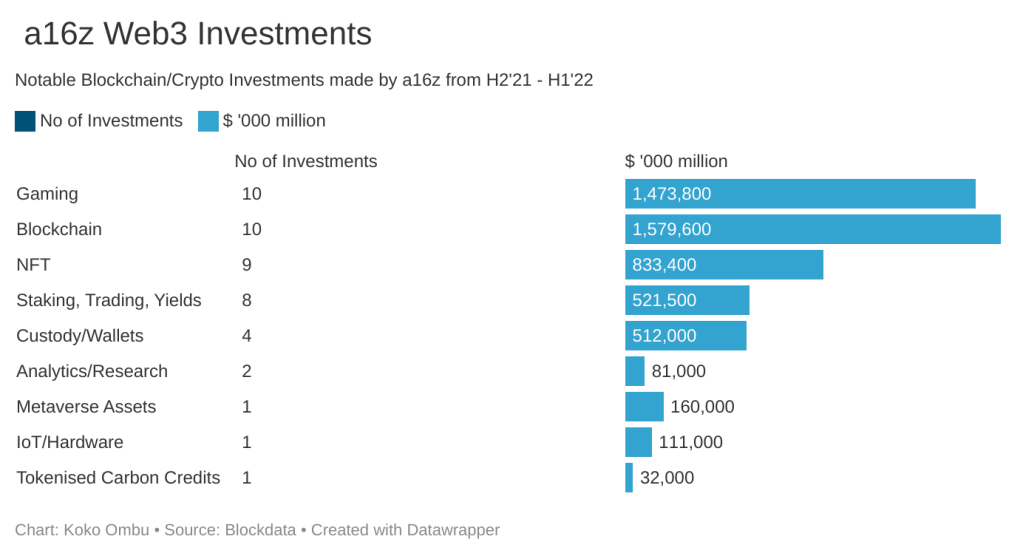

During this period, a16z has made investments in 56 startups in the following subsectors: blockchain, gaming, custodial/wallets, staking and trading exchanges, analytics, tokenised carbon credits, NFT, metaverse assets, IOT and hardware.

Of these investments, blockchain startups have swooped up the majority of the cash, trailed by gaming. With each having an equal investment total of 10. Investments in both segments exceeded the $1 billion mark, as blockchain shoots past gaming by over a $100 million.

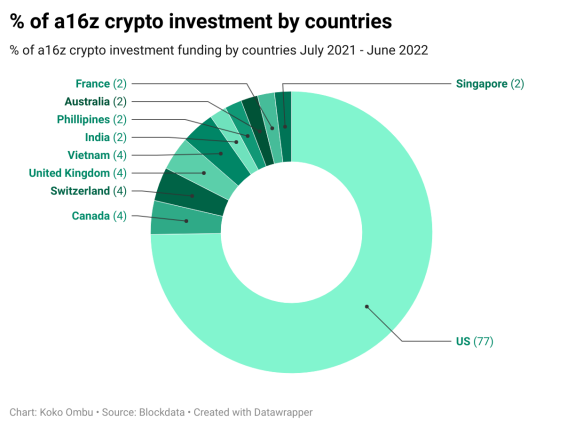

Investments by Country

A16Z invested in crypto startups across 4 major continents. Investment count includes 44 in the US, 2 each in Canada, Vietnam, United Kingdom and Switzerland. It made single investments in India, Phillipines, Australia, France and Singapore.

Relevance of a Venture fund’s strategy

As a Web3 startup founder or a prospective one, it is important to know how crypto focused VC firms invest their funds to be strategically stand a chance to be captured into their nets.

As a venture capital firm, understanding and tracking investment trends of the big players could be the the thin line between a sub par outing and a stellar performance.

Visualisations created with Tableau, Data Wrapper, Excel